扫码下载APP

及时接收最新考试资讯及

备考信息

| 教材更新说明 | V3.7更新内容 |

2020年9月8日,Becker软件已更新FAR和REG Course Update PDFs,增加了MCQs和Simulations,这些内容仅在2020年10月至12月考试中有所体现。

2020年10月1日,Becker 软件将会更新教材更新页、flashcards、MCQs和simulations,适用于2020年10月1日以后的AICPA考试。

FAR & REG V3.7更新内容:

| FAR V3.7 | ||

| 适用考期 | 更新内容 | |

| 2020.10.1以后 | FAR 2—Module 6 F2-27 | 1.2 Pass Key, Annual revenues of less than $100 million, are excluded from the definition of large accelerated filers or accelerated filers. |

| FAR 3—Module 5 F3-55 | 3.5 Adding specific variations to Partial-Year Depreciation. | |

| FAR 6—Module 3 F6-34 | Illustration 3 Swap Contract, ”LIBOR” change to”SOFR” | |

| FAR 6—Module 6 F6-70,71 | 5.1 Operating losses, Net Operating Loss Carryback and related Example 3 | |

| 2021.1.1以后 | FAR 4—Module 2 F4-29 | 4 Adding details to Transition to Equity Method。 |

| REG V3.7 | ||

| 适用考期 | 更新内容 | |

| 2020.10.1-12.31 | REG 1—Module 1 R1-4: | 2 Charity (no AGI limit) |

| REG 1—Module 2 R1-15: | 2.2 Nontaxable fringe benefits: Employer payment of student loans also excludable | |

| REG 1—Module 2 R1-21: | 2.10.1 IRA distribution: No required minimum distributions | |

| REG 1—Module 2 R1-27: | 2.18 Coronavirus-related distributions are not subject to penalty tax | |

| REG 1—Module 3 R1-29: | 1.2 The deduction for business interest expense is limited to 50 percent of business income | |

| REG 1—Module 5 R1-59-63; REG 5—Module 1 R5-9; REG 5—Module3 R5-30,32,33,34; | Excess business loss limitation suspended | |

| REG 2—Module 1 R2-5,7,8 | Traditional IRA: No required minimum distributions | |

| REG 2—Module 2 R2-22-24: | 2.4 No AGI limit on cash contributions to public charities by individuals | |

| REG 2—Module 2 R2-44,45: | 2.18 Employee retention credit available to eligible employers | |

| REG 4—Module 2 R4-10,45: | 1.3.4 The deduction for business interest expense is limited to 50 percent of business income | |

| REG 4—Module 2 R4-11 | Charitable Contributions (25 Percent of Adjusted Taxable Income Limitation) | |

| REG 4—Module 2 R4-18,25 | The chart indicates that the corporate charitable deduction is limited to 25 percent of "A." | |

| 2020.10.1以后 | REG 1—Module 1 R1-4; REG 2—Module 2 R2-3,13: | 2 Qualified charitable contributions (up to $300) |

| REG 1—Module 3 R1-31: | 1.4.2 Net Taxable Loss | |

| REG 1—Module 3 R1-44; REG 5—Module 3 R5-27: | Retirement plan contributions for partners (included as part of guaranteed payments)需填写1065表 | |

| REG 3—Module 5 R3-49: | 15-year Class: Includes qualified improvements to the interior of existing nonresidential building and certain improvements made directly to land | |

| REG 3—Module 5 R3-55 : | 1.5 Bonus Depreciation, Qualified property is personal property with a recovery period of 20 years or less, including qualified improvement property | |

| REG 4—Module 2 R4-18; REG 4—Module 4 R4-39,40: | Net Operating Loss: Carryback five years, carryforward indefinitely (2018–2020), No carryback, carryforward indefinitely (2021 and beyond) | |

| REG 4—Module 3 R4-25: | 1.4.4 Minimum Tax Credit 1.4.5 Employee Retention Credit | |

| REG 4—Module 2 R4-41,42: | The substance and calculations in Illustration 1 have not changed, but the actual years (2019, 2020, etc.) have been added for clarity | |

| REG 6—Module 6 R6-55: | 5.3 Substantial Authority Standard: The substantial authority standard is a position that has more than a 40 percent chance of succeeding in court. | |

| 2021.1.1以后 | REG 1—Module 3 R1-31: | 1.4.2 Net Taxable Loss |

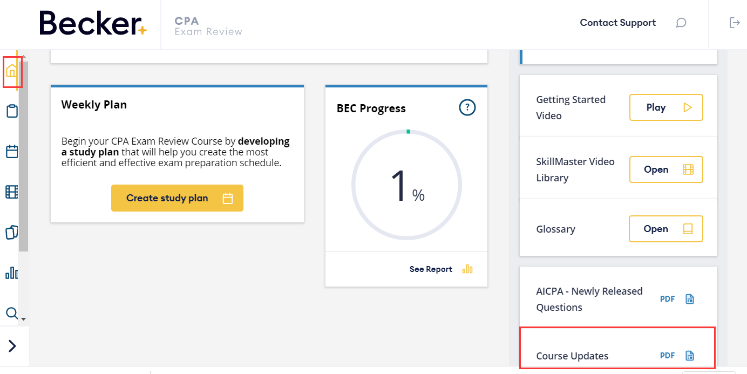

更新位置如下:

AICPA知识点琐碎,如果全靠自学那实在是有点难!如果有老师指导,听了老师的课之后再去看教材,那就可以更加准确的把握教材的重难点,把握教材的内容,更有针对性的去学习。在听课时要及时标记在课本上,在自己阅读课本时,除了要重点阅读标记内容外,还要补充阅读没有标记的内容,做到不遗漏任何一个知识点。查看AICPA课程>>

说明:因考试政策、内容不断变化与调整,正保会计网校提供的以上信息仅供参考,如有异议,请考生以部门公布的内容为准!

更多推荐:

Copyright © 2000 - www.chinaacc.com All Rights Reserved. 北京东大正保科技有限公司 版权所有