扫码下载APP

及时接收最新考试资讯及

备考信息

CFA一级财报分析怎么学?重难点汇总都在这儿了!财务报表分析是CFA一级考试的考试重点,内容涉及三大会计报表、现金流量测控、养老会计、管理会计等会计术语,考试难度不是很大但财报分析考试题量多,对于没有会计知识的考生来说难免感到头大,并且现在的考核方式更加灵活,大家还是要提起重视!

正保会计网校的老师给大家总结了CFA一级财报分析里面的9大重点难点,帮助大家更快的了解和掌握知识点,备考CFA一级考试的同学快来学习吧!内容比较多,大家也可以留存下文章链接呦!

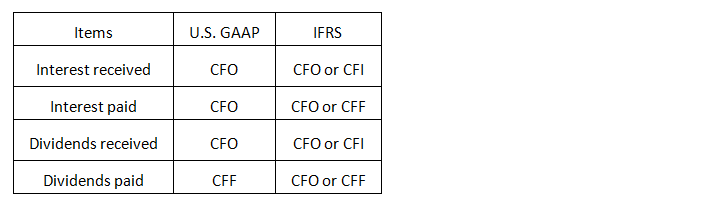

1) CFO计算

① Indirect method

• 起始点:net income

• 第一步:调整non-cash items

▶加回 Non-cash expenses or losses

▶减去 Non-cash revenues or gains

• 第二步:调整non-operating items

▶减去卖出PPE获得的gain

▶加回卖出PPE获得的loss

• 第三步:调整 the net changes in operating accruals

▶调整资产负债表中working capital

▶减去资产净增加 -ΔA

-Increase in non-cash operating asset accounts (Inventory, A/R)

▶加上负债净增加 +ΔL

+Increase in operating liability accounts (A/P)

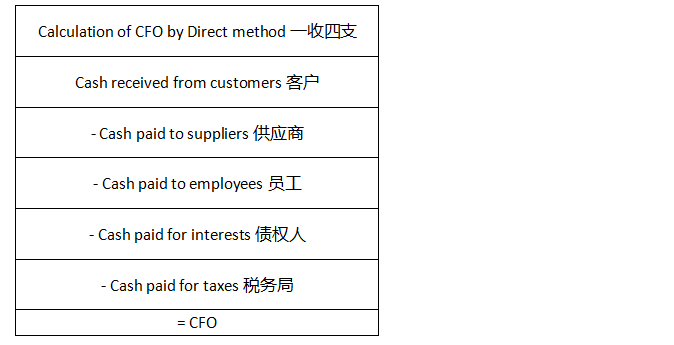

② Direct method

• Cash received from customers=net sales -Δ A/R + Δ Unearned Revenue

• Cash paid to suppliers.

▶-Cash paid to suppliers=-COGS - Δ inventory + Δ A/P

▶Inventory期末= Inventory期初+purchase-COGS

• - Cash paid to employees员工=-wage expense + Wage payables

▶wage payables期末= wage payables期初+ wage expense –cash paid to employees

• - Cash paid for interests债权人=-interest expense + Δinterest payables

• - Cash paid for taxes税务局=-tax expense + Δtax payables

2) CFI计算

• Cash used in purchase of fixed assets:

▶Book Value = Carrying value = Purchase cost – aggregate depreciation – Impairment

▶NBV end = NBV Begin + Purchase – Disposal NBV – Depreciation

• Proceeds received from sale of fixed assets.

▶Gain or loss = proceeds received – disposal NBV

▶Gain or loss resulting from disposal of PP&E or other long-term assets are NOT presented in the CFI; instead, cash generated should be calculated based on the gain or loss.

3) CFF计算

• Long-term debt: 增加代表现金流入,减少代表现金流出。

• Dividend paid:

▶Opening R/E + Net Income – Dividend declared = Ending R/E

▶Dividend paid = -Dividend declared + ΔDividend payables

• FCFF = EBIT×(1 – tax rate) + NCC – FCInv – WCInv

• FCFF = NI + NCC + Int (1 –Tax rate) – FCInv – WCInv

• FCFF = CFO – FCInv+ [Int×(1 – tax rate)]

• FCFE = FCFF – Int×(1 – tax rate) + Net borrowing

• FCFE = CFO – FCInv + Net borrowing

1) Activity ratios

• Inventory turnover = COGS / average inventory

• inventory management effectiveness.

• a high turnover ratio: could potentially hurt revenue

• A low inventory turnover ratio: slow-moving inventory

• Days of inventory on hand (DOH)= Number of days in period / inventory turnover

• Receivables turnover = Net revenue / average A/R

• Days of sales outstanding (DSO)= Number of days in period / receivables turnover

• Payables turnover = Purchase / average A/P

• Purchase=COGS+ Δinventory

• Number of days of payables= Number of days in period / payables turnover

• Total asset turnover=net revenue/ average total assets

• Fixed asset turnover=net revenue / average net fixed assets

• Working capital turnover=net revenue / average working capital

2) Liquidity ratio

• Current ratio = Current assets / Current liabilities

• Quick ratio = [cash + Short-term marketable securities + receivable] / Current liabilities = [current asset - inventories] / Current liabilities

• Cash ratio = [cash + marketable securities] / Current liabilities

• Defensive interval = (cash + marketable securities + receivables) / average daily expenditures

• Cash conversion cycle=DOH + DSO –Number of days of payables

3) Profitability ratios

• Return on Sales

▶Gross profit margin = Gross profits / net revenue

▶Operating profit margin = EBIT / net revenue

▶Pretax margin = EBT / net revenue

▶Net profit margin = NI / net revenue

• Return on investment

▶Operating ROA=Operating income/Average total assets

▶Return on assets (ROA) = NI / average total assets

▶Return on total capital = EBIT / Average short- and long-term debt and equity

▶Return on equity (ROE) = NI / average total equity

▶Return on common equity= (Net income – Preferred dividends)/Average common equity

4) Solvency ratio

• Leverage

▶Debt-to-equity ratio = D / E

▶Debt-to-capital= D/ (Average short- and long-term debt and equity)

▶Debt-to-assets = D / A

▶Financial leverage = A / E

• Coverage

▶Interest coverage = EBIT / Interest

▶Fixed charge coverage = (EBIT + lease payments) / (Interest + lease payments)

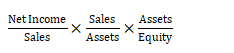

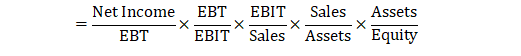

• ROE=net profit margin × asset turnover × leverage ratio=

• ROE=tax burden × interest burden × EBIT margin ×asset turnover × leverage ratio

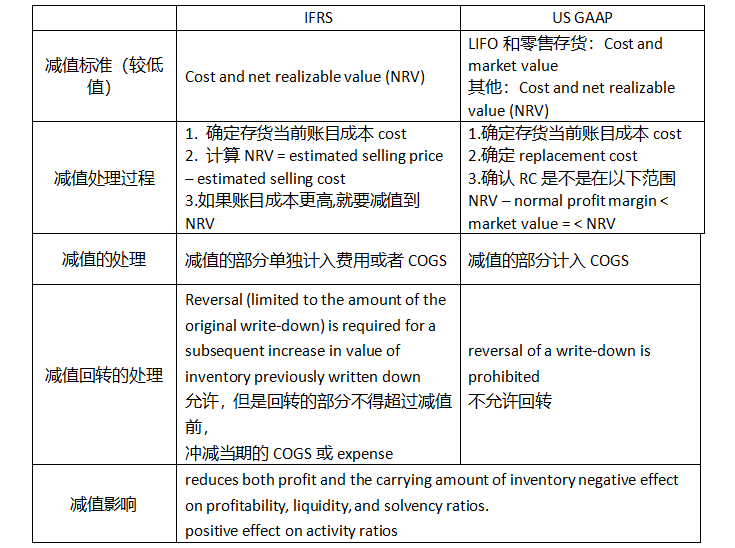

• 特例:agricultural and forest products and minerals and mineral products

• be measured at net realizable value (fair value less costs to sell and complete)

• quoted market price or market determined prices or values.

1) IFRS:

• 减值标准:carrying value> Recoverable amount

• 减值到:Recoverable amount = max [NRV, value in use]

2) GAAP:

• 减值标准:carrying value> Undiscounted expected future cash flows

• 减值到:fair value

3) Reversals of Impairments of Long-Lived Asset

• IFRS:允许,但不能超过原值

• GAAP:不允许,例外是held-for-sale

4) Held-for-sale

• Management’s intent is to sell it and its sale is highly probable.意愿卖出

• At the time of reclassification, assets previously held for use are tested for impairment.重分类时,减值测试

• the asset is written down to fair value less costs to sell.减值到NRV

• Long-lived assets held for sale cease to be depreciated or amortized.停止折旧

以上就是CFA一级财报分析怎么学,重难点汇总都在这儿了的相关内容,后期会为大家持续更新备考干货,可关注【 备考经验 】栏目查看哦!

说明:因考试政策、内容不断变化与调整,正保会计网校提供的以上考试信息仅供参考,如有异议,请考生以官方部门公布的内容为准!

相关推荐>>

Copyright © 2000 - www.chinaacc.com All Rights Reserved. 北京正保会计科技有限公司 版权所有

京B2-20200959 京ICP备20012371号-7 出版物经营许可证 ![]() 京公网安备 11010802044457号

京公网安备 11010802044457号

套餐D大额券

¥

去使用